Page Content

At the end of each month, many teachers check their pay statement to make sure that they have been paid according to their placement on the salary grid. They also pay close attention to deductions such as income tax, employment insurance, Canada Pension Plan, employee benefits and, one of the biggest of all, their Alberta Teacher Pension Plan contribution. It is a large deduction made to teachers’ salaries, but the pension will be the main form of income for most retired teachers when they choose to leave the classroom.

A teacher’s defined benefit pension payment is determined using a formula that is based on both the teacher’s salary and years of service. Each year of service and increased salary means a greater amount of pension when the teacher retires. In order to pay that pension promise in the future, the teacher makes a contribution each month. But how is this contribution calculated?

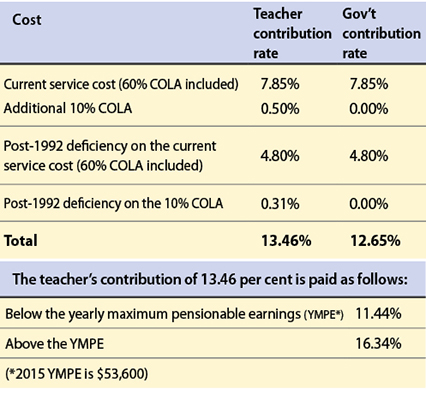

The current service cost is the largest portion of the pension plan contribution. It takes into consideration a number of factors, including when a teacher will retire, life expectancy and how much salaries will increase over time.

In fact, the plan’s mortality tables have recently been adjusted to take into consideration that teachers live longer, on average, than the general public. Other factors considered by the actuaries when calculating the contribution rates are the expected inflation rate and the expected rate of return.

Pension actuaries do a valuation every two years to determine contribution rates. Thus, if deficiencies are discovered, they must be eliminated, by law, within 15 years. Both teachers and government contribute more to the plan in order to eliminate these deficiencies within that 15-year time period.

Teachers also pay the full cost for the additional 10 per cent cost-of-living adjustment (COLA) for each year of service after 1992. They are also responsible for any deficiencies incurred by that extra COLA. Any service earned previous to 1992 is eligible for the 60 per cent COLA only.

Contribution rates for the 2014/15 school calendar year are as follows:

Therefore, a first-year teacher earning $60,000 will pay a total of $7,177.60 in yearly pension contributions, while a teacher earning $95,000 will pay a total of $12,896.60 in yearly pension contributions. A pension is not a gift. Teachers obtain their pensions the old-fashioned way — they earn them. ❚